Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

If you are interested in saving money and streamlining your finances or raising money for virtually any purpose as the piggy bank can`t quite do it, give us a call on 0800 298 3000 from a landline, 0333 003 1505 if on a mobile or use our on line enquiry form to see what low rate remortgages might be suited to you. We provide free quotations and you will not be under any obligation to proceed.

If you are interested in saving money and streamlining your finances or raising money for virtually any purpose as the piggy bank can`t quite do it, give us a call on 0800 298 3000 from a landline, 0333 003 1505 if on a mobile or use our on line enquiry form to see what low rate remortgages might be suited to you. We provide free quotations and you will not be under any obligation to proceed.Low Rate Remortgage Deals

Come to First Choice Finance for reliable low rate remortgage advice. Over the past few years or so rates have hovered around a historically low level and remortgaging onto one of these low rate remortgages can be an attractive option. It sounds easy enough but there are some things to look out for and certain obstacles that could trip you up. Mortgage lenders are feeling the pressure to keep rates low; this has resulted in some of the cheapest mortgage borrowing rates since time began. Great for borrowers everywhere? Well may be not, low mortgage rates and cheap mortgages come hand in hand but it isn`t the only factor you should consider. That is why we advise coming to a seasoned mortgage broker like ourselves to help you get low rate remortgage deals.

Come to First Choice Finance for reliable low rate remortgage advice. Over the past few years or so rates have hovered around a historically low level and remortgaging onto one of these low rate remortgages can be an attractive option. It sounds easy enough but there are some things to look out for and certain obstacles that could trip you up. Mortgage lenders are feeling the pressure to keep rates low; this has resulted in some of the cheapest mortgage borrowing rates since time began. Great for borrowers everywhere? Well may be not, low mortgage rates and cheap mortgages come hand in hand but it isn`t the only factor you should consider. That is why we advise coming to a seasoned mortgage broker like ourselves to help you get low rate remortgage deals.When you contact us on the above number, one of our own mortgage advisers will be able to navigate the many products on offer from our panel and provide you with a free personalised illustration. A quote suited specifically to your needs and requirements.

Examples Of Low Rate Remortgages

Mortgage rates can often be confusing, whether they are low or not. Sometimes it is easier to understand what you will be paying when the numbers are plainly laid out in front of you. Here are a few examples of the capital repayment (C/R) mortgage payments involved with low rate remortgages (the rate cited is an initial rate and is for illustrative purposes only for people with a clean credit record):Borrowing £50,000 over 25 years at 2%.

Monthly Repayment= £213.42 (C/R)

Borrowing £70,000 over 15 years at 2%.

Monthly Repayment= £453.98 (C/R)

Borrowing £175,000 over 35 years at 2%.

Monthly Repayment= £583.37 (C/R)

Bad Credit Remortgage Rates

General consensus is that the best low rate remortgages are reserved for the `best borrowers` and that some lender`s may `cherry pick` their deals. To a degree this can be considered true but what is considered the `best borrower`? There are a number of factors that a mortgage lender looks at when assessing an application. Criteria spans from loan to value, your credit history, income, age, employment status, being on the voters roll and much more and each lender will view these slightly differently. What this means is that there is no, one `best borrower` and many lenders will view an application on it`s own merits. Some quite low rate remortgages are even available to clients with bad credit on their credit file, yes you are not realistically going to get the lowest rate in the market but knowing where to look can be the difference between a successful or declined application. That is where First Choice Finance come in to play - fill in our short enquiry form and once we have established your specific requirements we can approach lenders you are likely to be accepted with, saving you time and potential disappointment.Mortgage Repayment Calculator

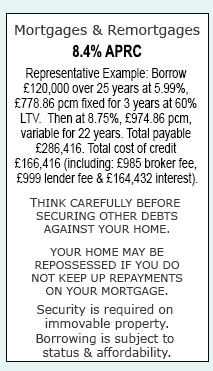

If you have been researching the market you are likely to have come across some of the low rate remortgages available. It is all well and good knowing these rates but until you can see how it will translate into a monthly payment you won`t be able to see how much it might save you. Head over to our selection of mortgage and remortgage calculators so you can establish how much your monthly repayment might be at various rates. The numbers can do the talking but you need to know what rates you qualify for so to see how much you might be able to save give us a call on 0800 298 3000 (landline) 0333 003 1505 (mobile).Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential